by admin | Feb 2, 2026 | All news

Why January Cash Flow Gets Messy (Even When Business Is Good) January has a way of catching out even well-run businesses. You might have a full order book and customers queuing up, but the bank balance tells a different story. Sound familiar? We see this pattern...

by admin | Dec 19, 2025 | All news, Growth and Financial Planning

Commercial Lending Rates Explained: What UK Businesses Need to Know in 2026 The cost of borrowing has become one of the biggest talking points for UK businesses. With interest rates, inflation, and market confidence all shifting rapidly, commercial lending can feel...

by Lucy Painter | Dec 9, 2025 | All news

Home » All news Are YOU making any of these common mistakes in Asset Finance? We meet with many businesses and often notice that some businesses are at risk of falling into these bad habits when looking at asset finance needs….. Chasing the lowest monthly...

by Lucy Painter | Nov 27, 2025 | All news, Growth and Financial Planning, Industry Insights and Challenges

In plain terms: the Autumn Budget 2025 has done little to restore robust business confidence. Much of it remains subdued, cautious and conditional, rather than optimistic or growth-oriented. Many businesses are now in a “wait and see” mode: deferring expansion,...

by Lucy Painter | Nov 6, 2025 | All news

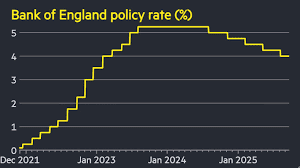

Entrepreneurs and small-business leaders: the Bank of England has chosen to leave the base interest rate at 4%, and that decision matters for you. Here’s a breakdown of the why and how you might respond. Why the rate stay? Inflation remains above target: the UK CPI...

by Lucy Painter | Oct 28, 2025 | All news

Are YOU making any of these? We meet with many businesses and often notice that some businesses are at risk of falling into these bad habits when looking at asset finance needs….. Chasing the lowest monthly repayment without looking at the total cost Low monthly...