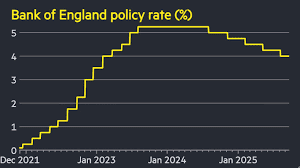

Entrepreneurs and small-business leaders: the Bank of England has chosen to leave the base interest rate at 4%, and that decision matters for you. Here’s a breakdown of the why and how you might respond.

Why the rate stay?

- Inflation remains above target: the UK CPI is running at around 3.8 % (vs the BoE’s 2 % target) which means the central bank isn’t ready to back off the inflation fight.

- Growth is sluggish, but inflation risks remain: in its September 2025 meeting, the Monetary Policy Committee (MPC) noted that while economic growth is weak, “we’re not out of the woods yet” on inflation.

- A cautious approach to further cuts: the BoE signalled that even though rates may eventually come down, any cuts will be gradual and careful so as not to trigger inflationary or market-stability issues.

- Balancing the broader picture: The Bank also slowed its “quantitative tightening” (selling government bonds) programme, in recognition of fragile bond markets and the cost of government borrowing.

What this means for SME business owners

- Borrowing costs remain elevated: With the base rate at 4%, many lending & overdraft facilities will continue to reflect that reality. If you’re planning new investment financed with debt, you’ll want to factor in that interest rates are not about to drop sharply overnight.

- Budgeting for uncertainty: Because the MPC flagged inflation risks and noted further cuts are not guaranteed soon, you’ll want to keep contingency buffers in your cost / cash-flow plans for interest, supplier-price and wage pressures.

- Opportunity for review: If you have variable-rate borrowing, or lines of credit, this might be a good moment to lock in terms or renegotiate if possible — or at least revisit the assumptions underpinning your financial forecasts.

- Watch for timing of cuts: The Bank’s stance suggests that while the rate-cut path is still in view, the timing is more uncertain. That means it may be unwise to assume lower rates will arrive this quarter and base investment decisions exclusively on that expectation.

- Strategic investment decisions: If you were holding off on investment because you were hoping for immediate rate relief, you might have to reconsider. Either push ahead while costs are manageable or maintain flexibility (e.g. staging investment) so that you’re ready when any cuts arrive.

In short: 4% feels “high” compared to an ideal lower rate environment for borrowing, but the BoE is signalling it’s choosing stability over haste. For SME owners, this means staying prudent, reviewing finance structures, and avoiding bets that depend on fast-falling borrowing costs.

If you’re an SME owner and want to run through how this affects your borrowing strategy, cash-flow model or planned investment, we’d be happy to connect and talk through options and scenarios.