Latest News

Filter stories by category

Cash Flow Crunch? Why a Business Working Capital Loan Might Be Your Q1 Safety Net

Why January Cash Flow Gets Messy (Even When Business Is Good) January has a way of catching out even well-run businesses. You might have a full order book and customers queuing up, but the bank balance tells a different story. Sound familiar? We see this pattern...

Feb 2, 2026 | 4 min read

Commercial Lending Rates Explained: What UK Businesses Need to Know in 2026

Commercial Lending Rates Explained: What UK Businesses Need to Know in 2026 The cost of borrowing has become one of the biggest talking points for UK businesses. With interest rates, inflation, and market confidence all shifting rapidly, commercial lending can feel...

Dec 19, 2025 | 3 min read

5 common pitfalls in Asset Finance (and how to avoid them) #2

Are YOU making any of these common mistakes in Asset Finance? We meet with many businesses and often notice that some businesses are at risk of falling into these bad habits when looking at asset finance needs..... Chasing the lowest...

Dec 9, 2025 | 2 min read

Business Growth in the Wake of the Autumn Budget 2025 – 5 Tips for SMEs

In plain terms: the Autumn Budget 2025 has done little to restore robust business confidence. Much of it remains subdued, cautious and conditional, rather than optimistic or growth-oriented. Many businesses are now in a “wait and see” mode: deferring expansion,...

Nov 27, 2025 | 3 min read

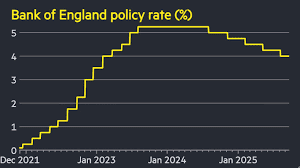

Why the BoE held rates at 4 % – and what SME owners should know

Entrepreneurs and small-business leaders: the Bank of England has chosen to leave the base interest rate at 4%, and that decision matters for you. Here’s a breakdown of the why and how you might respond. Why the rate stay? Inflation remains above target: the UK...

Nov 6, 2025 | 3 min read

5 common pitfalls in Asset Finance (and how to avoid them)

Are YOU making any of these? We meet with many businesses and often notice that some businesses are at risk of falling into these bad habits when looking at asset finance needs..... Chasing the lowest monthly repayment without looking at the total cost Low monthly...

Oct 28, 2025 | 2 min read

Alternatives to Traditional Business Loans: Exploring Creative Financing Options

When your business needs funding, a bank loan isn’t the only game in town. In fact, for many small and medium businesses, the bank is often the slowest, most rigid option. Over the years, we’ve seen companies across Nottinghamshire and beyond, thrive by tapping...

Sep 22, 2025 | 4 min read

Your Catalyst for Change: Growth, Financing & Exit Planning for £1m+ Businesses

Exclusive interactive workshop for ambitious business owners Are you leading a £1m–£10m business and exploring the next phase of growth? Whether you’re considering investment, acquisitions, or even an exit, this high-impact, small-group workshop...

Sep 4, 2025 | 1 min read

The Role of a Commercial Finance Broker: How We Add Value to Your Business

Navigating the complex world of business finance can be daunting for any company, regardless of size or sector. At FundingRound, we understand that securing the right financial solution isn't just about finding funding – it's about finding the...

Sep 4, 2025 | 4 min read

Top 5 Industries Benefiting from Commercial Financing

In my years as a commercial finance broker at FundingRound, I've witnessed firsthand how access to capital transforms businesses across the UK. Based in Newark, Nottinghamshire, we've helped countless companies navigate their financing needs, and I've noticed...

Jun 19, 2025 | 4 min read

What Lenders Look for in a Business Loan Application

Understanding the Lender's Perspective When you're applying for business funding, it's crucial to understand what lenders are looking for before submitting your application. At Funding Round, we've helped countless businesses across Nottinghamshire and beyond...

Jun 19, 2025 | 3 min read

Top 7 Things Landlords Need to Know About the New Renters’ Rights Bill

The landscape of rental housing is evolving with the introduction of the New Renters’ Rights Bill, bringing significant changes that landlords must adapt to and it is expected to pass into law in Summer 2025. As the Bill is currently written, the...

Mar 4, 2025 | 4 min read